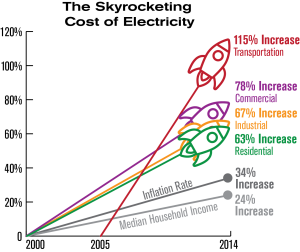

Financial backers hoping to set up a topical portfolio round environmental extrude have some awesome picks. Two of the maximum outstanding guides contain environmentally pleasant energy ventures and corporations with inexperienced drives. The Electricity rates provide the best outcome in the gains of the saving nature.

Sun primarily based totally, a Top Choice

Environmentally pleasant energy is crucial to doling out with the usage of petroleum products. Normal strength sources, for example, the breeze and solar can deliver modest energy without damaging infection or carbon dioxide. Many corporations are investigating higher processes to enhance and scale those innovations.

On the off threat that you are inclined to dance at the lookout, daylight primarily based innovation remains brand new to the scene place with the optionally available strength region. Buying shares in daylight-powered charger manufacturers is an easy technique for placing sources into environmentally pleasant energy. As nicely as shopping man or woman shares, the Market Vectors Solar Energy ETF (KWT) and Guggenheim Solar Fund (TAN) are each round the arena broadened selections in oversaw funds.

On the institutional front, there are likewise some chiefs taking good-sized wagers at the earnings of the environmentally pleasant energy areas. Numerous normal aid chiefs, who include BlackRock and Fidelity, have made reserves that concentrate on the sustainable energy region.

Green corporations may get a boost from the $1.2 Trillion Infrastructure Investment and Jobs Act advocated into law through President Joe Biden on Nov. 15, 2021. It reserves large consumptions, as a rule, the most important in U.S. history on inexperienced drives, for example, inexhaustible/optionally available strength sources, public travel, and easy water.

Worldwide Opportunities

Across the globe, inexperienced tech contributing has been large for a few international locations of the arena. The Global Trends in Renewable Energy Investment 2020 record, jointly allotted through the Frankfurt School and the U.N. Ecological Program, spreads out speculations throughout the final ten years through a type of innovation and country.

Environmentally pleasant energy Capacity Investment

China has through a protracted shot outperformed the rest of the arena with its environmentally pleasant energy speculations. From 2010 to 2019 China detailed $818 billion in environmentally-pleasant energy speculations, winning over all of Europe at $719 billion and nearly multiplying America with the runner-up positioning at $392 billion.

Green Initiatives

Organizations with green energy strength drives can likewise be an exceptional spot to place sources into for an environmental extrude-distinct portfolio. These are corporations with stable hobbies in carbon counterbalances, in your price range materials, meat substitutes, electric-powered vehicles, or different low-carbon alternatives in evaluation to present advancements.

Putting sources into inexperienced drives has for a while been regarded as a risky suggestion: The excessive capital hypothesis and complicated framework requirements suggest that consumptions regularly offset benefits, mainly temporarily. In any case, many corporations see lengthy haul blessings to those speculations and feature located a manner method to set themselves and the weather up for an advanced future.

For a few monetary backers, an environmental extra de-targeted portfolio can likewise suggest maintaining far from corporations with expanded levels of discharges like oil, gas, and compound corporations that rely upon oil or unique hydrocarbons for his or her advent.